Record U.S. Oil Production in March 2025—But Demand Is Telling a Different Story

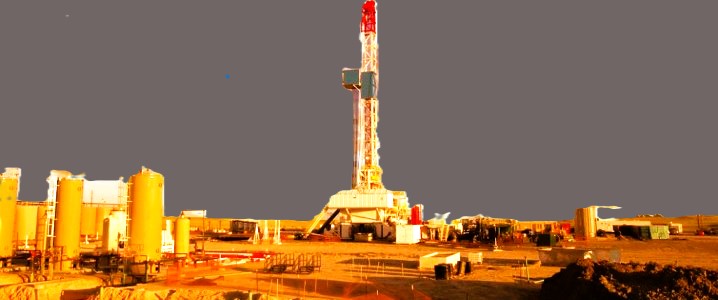

The U.S. oil industry just hit a new milestone. According to freshly released data from the Energy Information Administration (EIA), U.S. crude oil production reached an all-time high of 13.488 million barrels per day in March 2025. This breaks the previous record set in October 2024 and reflects steady momentum from major oil-producing regions like the Permian Basin and the Gulf Coast.

But while the supply side is booming, the demand side is showing clear signs of softening—a concerning signal for energy markets heading into the summer.

Supply Strength: U.S. Production Hits New High

In just one month, U.S. crude output rose from 13.153 million barrels per day in February to 13.488 million in March—a sign of resilience and efficiency among producers, even as drilling activity slows nationwide. This increase underscores how key players in the Permian and Gulf Coast regions are continuing to pump at near-maximum capacity.

Demand Weakens: Lowest Petroleum Consumption in a Year

While supply surges, demand is faltering. Total petroleum products supplied—a broad gauge of domestic oil consumption—fell to 19.95 million barrels per day in March, the lowest level in over a year. That’s down from 20.225 million bpd in February and continues a trend of monthly declines since January.

This drop in demand is raising red flags, especially for refiners and exporters who typically rely on a seasonal consumption boost during the summer driving season. Rising inventories add another layer of concern, indicating a potential oversupply in the coming months.

Imports and Drilling Activity Tell a Mixed Story

Crude oil imports in March totaled 178.4 million barrels, slightly higher than February due to the extra day in the month. However, on a daily average basis, imports were lower. Meanwhile, imports of finished products like gasoline blending components and jet fuel hit 17.8 million barrels, further emphasizing the U.S. reliance on refined fuels even amid record domestic output.

Drilling activity continues to decline. In May, the U.S. rig count fell for the fifth consecutive week, dropping to just 563 active rigs, the lowest since late 2021. The number of oil-directed rigs fell to 461, with significant reductions in both New Mexico and the Permian. The message from producers is clear: capital discipline and shareholder returns remain top priorities.

The Big Picture: More Oil, Less Drilling, Weaker Demand

This current energy landscape presents a striking paradox: The United States is producing more oil than ever while operating fewer rigs and facing softening domestic demand. As we head into the high-demand summer season, the imbalance between strong supply and shrinking consumption could significantly impact pricing, exports, and refinery margins.

Final Thoughts: A Summer of Uncertainty for Oil Markets

The U.S. oil industry is entering summer 2025 with record-breaking production but growing uncertainty. If demand doesn’t pick up and inventories continue to build, producers may be forced to rethink their strategies. With global economic signals mixed and domestic consumption faltering, the coming months will test the market’s ability to adapt.

Stay tuned as we continue to monitor key trends shaping the future of oil production, demand, and energy policy in the U.S.